Advertisement

-

Published Date

December 24, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

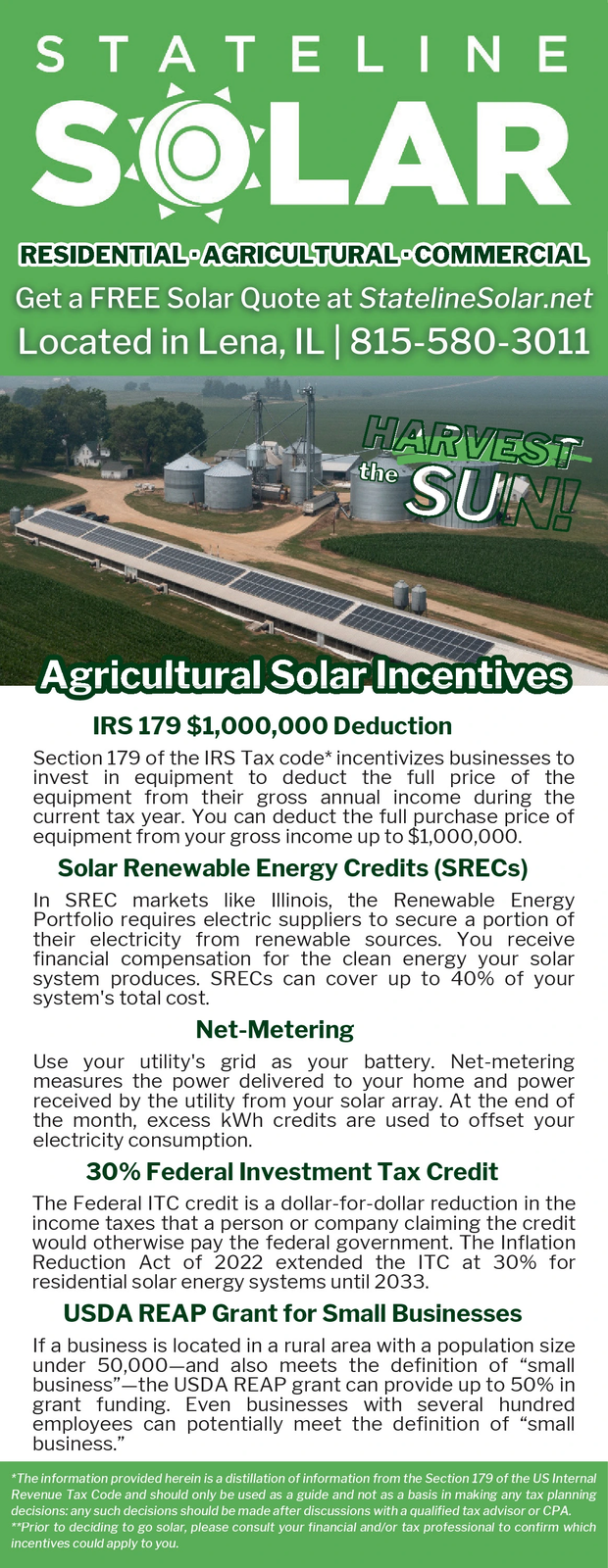

STATELINE SOLAR RESIDENTIAL AGRICULTURAL-COMMERCIAL Get a FREE Solar Quote at StatelineSolar.net Located in Lena, IL | 815-580-3011 HARVEST the SUN! Agricultural Solar Incentives IRS 179 $1,000,000 Deduction Section 179 of the IRS Tax code* incentivizes businesses to invest in equipment to deduct the full price of the equipment from their gross annual income during the current tax year. You can deduct the full purchase price of equipment from your gross income up to $1,000,000. Solar Renewable Energy Credits (SRECs) In SREC markets like Illinois, the Renewable Energy Portfolio requires electric suppliers to secure a portion of their electricity from renewable sources. You receive financial compensation for the clean energy your solar system produces. SRECS can cover up to 40% of your system's total cost. Net-Metering Use your utility's grid as your battery. Net-metering measures the power delivered to your home and power received by the utility from your solar array. At the end of the month, excess kWh credits are used to offset your electricity consumption. 30% Federal Investment Tax Credit The Federal ITC credit is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The Inflation Reduction Act of 2022 extended the ITC at 30% for residential solar energy systems until 2033. USDA REAP Grant for Small Businesses If a business is located in a rural area with a population size under 50,000-and also meets the definition of "small business" the USDA REAP grant can provide up to 50% in grant funding. Even businesses with several hundred employees can potentially meet the definition of "small business." *The information provided herein is a distillation of information from the Section 179 of the US Internal Revenue Tax Code and should only be used as a guide and not as a basis in making any tax planning decisions: any such decisions should be made after discussions with a qualified tax advisor or CPA. **Prior to deciding to go solar, please consult your financial and/or tax professional to confirm which incentives could apply to you. STATELINE SOLAR RESIDENTIAL AGRICULTURAL - COMMERCIAL Get a FREE Solar Quote at StatelineSolar.net Located in Lena , IL | 815-580-3011 HARVEST the SUN ! Agricultural Solar Incentives IRS 179 $ 1,000,000 Deduction Section 179 of the IRS Tax code * incentivizes businesses to invest in equipment to deduct the full price of the equipment from their gross annual income during the current tax year . You can deduct the full purchase price of equipment from your gross income up to $ 1,000,000 . Solar Renewable Energy Credits ( SRECs ) In SREC markets like Illinois , the Renewable Energy Portfolio requires electric suppliers to secure a portion of their electricity from renewable sources . You receive financial compensation for the clean energy your solar system produces . SRECS can cover up to 40 % of your system's total cost . Net - Metering Use your utility's grid as your battery . Net - metering measures the power delivered to your home and power received by the utility from your solar array . At the end of the month , excess kWh credits are used to offset your electricity consumption . 30 % Federal Investment Tax Credit The Federal ITC credit is a dollar - for - dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government . The Inflation Reduction Act of 2022 extended the ITC at 30 % for residential solar energy systems until 2033 . USDA REAP Grant for Small Businesses If a business is located in a rural area with a population size under 50,000 - and also meets the definition of " small business " the USDA REAP grant can provide up to 50 % in grant funding . Even businesses with several hundred employees can potentially meet the definition of " small business . " * The information provided herein is a distillation of information from the Section 179 of the US Internal Revenue Tax Code and should only be used as a guide and not as a basis in making any tax planning decisions : any such decisions should be made after discussions with a qualified tax advisor or CPA . ** Prior to deciding to go solar , please consult your financial and / or tax professional to confirm which incentives could apply to you .